Guide to Assembling an Electric Two-Wheeler

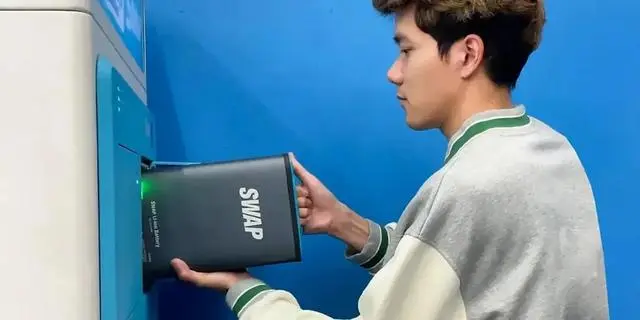

### **Guide to Assembling an Electric Two-Wheeler** #### **1. Preparation** **Tools Required:** – Screwdriver (Phillips and flathead) – Allen wrench set – Socket wrench set – Pliers – Adjustable wrench – Torque wrench – Scissors or wire cutters – Electrical tape – Zip ties **Components:** – Electric motor – Battery pack – Frame – Front and rear wheels – Handlebars – Brake levers and cables – Throttle assembly – Controller – Display unit – Pedals (if applicable) – Chain or belt – Charger – Bolts, nuts, and washers #### **2. Frame Assembly** 1. **Unpack the Frame:** – Remove the frame from the packaging and inspect for any damage. – Place the frame on a stable, flat surface for assembly. 2. **Attach the Front Fork:** – Insert the front fork into the head tube of the frame. – Secure it with the headset bearings, spacers, and top cap. – Tighten the top cap and stem bolts using the Allen wrench. 3. **Install the Handlebars:** – Attach the handlebars to the stem. – Align the handlebars and tighten the bolts on the stem clamp. #### **3. Wheel Assembly** 1. **Install the Rear Wheel:** – Align the rear wheel with the dropouts on the frame. – Insert the axle into the dropouts and secure it with nuts and washers. – Tighten the nuts with a socket wrench. 2. **Install the Front Wheel:** – Align the front wheel with the dropouts on the front fork. – Insert the axle and secure it similarly to the rear wheel. 3. **Adjust the Wheels:** – Ensure both wheels spin freely and are aligned correctly. – Adjust the tension of the spokes if necessary. #### **4. Brake System Installation** 1. **Attach the Brake Levers:** – Mount the brake levers on the handlebars. – Secure them in place with the provided bolts. 2. **Install the Brake Calipers:** – Attach the front and rear brake calipers to their respective mounts on the frame and fork. – Use the appropriate bolts to secure them. 3. **Connect the Brake Cables:** – Run the brake cables from the levers to the calipers. – Attach the cables to the calipers and adjust the tension to ensure proper braking. #### **5. Motor and Battery Installation** 1. **Install the Electric Motor:** – If the motor is hub-mounted, ensure it’s securely attached to the wheel hub. – If mid-drive, mount it to the designated area on the frame. 2. **Install the Battery Pack:** – Place the battery pack in its designated area on the frame. – Secure it with the provided brackets and bolts. – Ensure the battery is properly aligned and securely fastened. 3. **Connect the Motor and Battery:** – Attach the motor’s power cable to the battery’s output connector. – Ensure the connection is tight and secure. #### **6. Throttle and Controller Installation** 1. **Mount the Throttle:** – Attach the throttle assembly to the handlebars. – Secure it with the screws provided. 2. **Install the Controller:** – Mount the controller to the frame using the provided brackets or screws. – Ensure it’s in a location that is protected from water and debris. 3. **Connect the Wiring:** – Connect the throttle, brake sensors, and motor to the controller. – Use zip ties to secure the wiring neatly along the frame. #### **7. Display Unit Installation** 1. **Mount the Display:** – Attach the display unit to the handlebars. – Secure it with the provided clamp or screws. 2. **Connect the Display:** – Plug the display unit into the controller. – Ensure the connection is firm. #### **8. Pedal and Chain/Belt Installation** 1. **Install the Pedals:** – Attach the left and right pedals to the crank arms. – Use a wrench to tighten them securely. 2. **Install the Chain/Belt:** – If your bike uses a chain, loop it around the sprockets and join the ends. – For a belt drive, ensure the belt is properly tensioned and aligned. #### **9. Final Adjustments** 1. **Check All Connections:** – Ensure all electrical connections are secure and properly insulated. – Double-check that all bolts, nuts, and screws are tight. 2. **Adjust the Seat and Handlebars:** – Set the seat height and handlebar position to a comfortable level. – Tighten the adjustment bolts. 3. **Test the Brakes and Throttle:** – Squeeze the brake levers to ensure they engage properly. – Test the throttle to confirm smooth acceleration. #### **10. Initial Power-Up and Testing** 1. **Charge the Battery:** – Connect the charger to the battery and plug it into a power source. – Allow the battery to charge fully before the first ride. 2. **Turn on the System:** – Power on the bike using the main switch or button. – Check that the display lights up and shows the correct information. 3. **Test Ride:** – Take the bike for a short test ride. – Check for any unusual noises, vibrations, or issues. – Ensure that the motor, brakes, and throttle are functioning correctly. #### **11. Maintenance Tips** – Regularly check tire pressure and tread wear. – Inspect the brake pads and adjust or replace them as needed. – Keep the chain or belt lubricated and properly tensioned. – Periodically check the battery’s charge level and performance. – Clean the bike regularly to prevent dirt and debris buildup. This guide should help you successfully assemble your electric two-wheeler. Always follow safety precautions and consult the manufacturer’s manual for specific instructions related to your model.

Guide to Assembling an Electric Two-Wheeler Read More »

2-252x57.png)