Cai Jihua: A Chinese Entrepreneur in Indonesia Selling Electric Motorcycles and Competing with Honda**

Cai Jihua is an ethnic Chinese entrepreneur who came to China in 2001 to do business.

His first venture was in mobile phone trade, exporting products to Indonesia. After accumulating wealth and experience, Cai opened his own processing factory to export mobile phone batteries, chargers, and other related products, with the market still focused on Indonesia.

At the peak of power bank profits, Cai also engaged in the power bank business for a year in 2013. However, the industry soon fell into a vicious cycle of burning cash, raising funds, and price wars. The entry of Xiaomi shattered the price bottom line for power banks.

Cai pivoted and, along with a few friends, founded Laidian Technology in 2014 to focus on shared power banks. Cai took charge of all hardware manufacturing for Laidian. At its peak, the company generated over a million yuan in daily revenue.

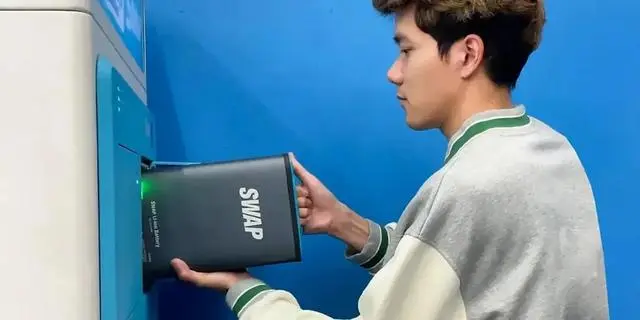

In 2018, Cai’s enthusiasm for battery manufacturing shifted towards electric two-wheelers. In 2019, he exited Laidian and established SWAP in Indonesia, selling two types of products: electric motorcycles and battery swapping solutions. The former operates under a separate brand called SMOOT, while the latter involves setting up battery swapping stations in Indonesia to provide shared batteries. This approach differs significantly from most electric motorcycle brands that only sell vehicles and use direct charging. “The core of the brand is understanding your market, rather than jumping into a business everyone else is doing,” said Cai. “Our competitor is Honda’s gasoline motorcycles.”

In his second entrepreneurial venture, Cai once again found himself in a leading position. SWAP became the first brand in Indonesia to successfully implement a battery swapping model, with over 1,500 battery swap stations established, accounting for 70% of local battery swapping cabinets. In the electric motorcycle market, SWAP’s sales account for more than 30%.

With internet giants like Grab and Lazada shifting their delivery services from fuel to electric, delivery personnel are now using SWAP’s electric motorcycles to deliver goods, with the partnership logo prominently displayed on the motorcycles, effectively promoting the brand throughout Indonesia.

**Identifying the Right Market Approach**

Initially, Cai considered two plans: expanding the shared power bank business into Indonesia and implementing a battery swapping model in the Chinese electric vehicle market.

The first plan faced a significant barrier: Indonesia’s online payment system does not support deposit-free transactions, making it difficult to promote shared power banks. In China, the shared power bank model only exploded after the introduction of deposit-free policies.

The second plan proved unfeasible because the battery swapping model in China predominantly targets B-end customers, such as food delivery riders and couriers, who typically opt for monthly subscription packages costing around 200-300 yuan. However, for C-end customers, using electric vehicles is not a necessity, with short travel distances and infrequent charging, making direct charging a more suitable option.

Cai noted that the critical issue in China is that car manufacturers and battery producers operate independently without communication protocols, making it difficult to access battery usage data.

In Indonesia, however, the situation is entirely different.

Motorcycles are a primary mode of transportation in Indonesia, especially in a country that has the highest motorcycle sales in Southeast Asia. In many Indonesian households, motorcycles hold a unique status, with some users parking them in their living rooms for security. In certain cases, a motorcycle’s value can even exceed that of a house.

The development of electric motorcycles has been relatively slow. When Cai returned to Indonesia to establish SWAP, electric vehicles were still in their early stages, with few startups in the market. Consumers were primarily concerned about limited range, which deterred them from longer trips. Cai and his team conducted research indicating that the average daily riding distance in Indonesia is about 50 kilometers, taking roughly 75 minutes. The market prompted Cai to consider whether the mature electric four-wheeler and two-wheeler markets, along with comprehensive policies for transitioning from fuel to electricity in China, could also apply to Indonesia. “Electrification is definitely a global trend,” Cai asserted. He estimated that with a population of 280 million, Indonesia’s acceptance of electric motorcycles starts from zero, presenting a significant opportunity.

Xu Lejia, founding partner of Huoshui Capital, observed that “Indonesia will have its own role and status in the future revolution of global battery manufacturing.” He noted interest in Indonesia’s new energy market as early as 2019 and shifted from uncertainty to certainty by the second half of 2020.

As various domestic new energy companies began discussing opportunities to establish subsidiaries in Indonesia, Xu Lejia resumed his focus on the Indonesian new energy market, noting that electric two-wheelers represent a larger market with lower barriers than four-wheelers.

Indonesia is well-suited for electric motorcycles due to its abundant natural resources, being the world’s largest producer of nickel, with reserves totaling 21 million tons, 70% of which are suitable for battery production.

Cai’s choice of the battery swapping model is not a new avenue; two local companies had attempted it before but failed. “They simply brought a few products from China to launch at a press conference and then disappeared,” Cai said. The battery swapping model requires heavy asset operation and higher demands on infrastructure, teams, and technology. Direct charging remains mainstream in Indonesia.

However, Cai recognized the compelling convenience of the battery swapping model, which “reduces battery wear costs and time costs.”

In Indonesia, standard charging power is 500-600 watts, and most households have a supply of 900 watts. Fully charging a high-power electric motorcycle takes six hours and can travel at least 100 kilometers. “With battery swapping, it takes less than a minute,” Cai noted.

While there are reference companies in the market, Xu Lejia’s early interest was in the Taiwanese brand Gogoro, which went public in the U.S. in 2021. He observed that Gogoro had failed to expand beyond Taiwan due to an uncompetitive supply chain and low product cost-effectiveness. Thus, he concluded that the battery swapping model had significant potential, stating, “Utilizing China’s supply chain can lead to the emergence of another large company.” SWAP was the first company Huoshui Capital invested in within this sector.

Cai possesses numerous advantages: he has extensive manufacturing experience, access to Chinese supply chain resources, and experience from Laidian that equips him to scale and automate equipment with minimal personnel.

He established two teams: a technology research and development team in Guangzhou, close to the supply chain, and a manufacturing team in Indonesia to optimize costs. The key to the battery swapping model lies in the deployment and operation of battery swap cabinets.

This logic closely resembles that of the shared power bank business; expanding a power bank’s physical size by 20 times results in a battery swap cabinet for two-wheelers. The challenge lies in simultaneously operating two products: the motorcycle and the swap cabinet.

Initially, Cai planned to collaborate with third-party electric motorcycle brands to use SWAP’s batteries and swapping solutions but could not reach agreements. “They thought battery swapping wasn’t a viable solution and were concerned we wouldn’t succeed,” Cai explained.

Thus, the SMOOT electric motorcycle brand was born. Consumers purchasing SMOOT motorcycles would have to accept SWAP’s battery swapping model, which meant Cai had to tap into new consumer groups, including those purchasing electric motorcycles for the first time and those transitioning from gasoline motorcycles to electric. A year after the company’s establishment, products began rolling out in 2021, with Cai dedicating the first year to research and development and building the supply chain. The battery cell supplier is Guoxuan High-Tech, while the motorcycle suppliers are Xinri and Qianjiang.

A core aspect of market penetration is the willingness to distribute products widely, according to Cai. This logic stems from his experience with Laidian, where the company established over 400,000 distribution points at its peak. As the first shared power bank brand in the market, failing to act quickly would risk losing market share to competitors.

Initially, accumulating data was vital, with the distribution strategy targeting areas with high user density. If a swap cabinet is fully stocked with seven batteries, fewer units would be deployed in areas with lower user numbers. With data in hand, average values could be calculated, such as how many kilometers should have a swap cabinet and how many sites could manage at least 20 swap cabinets.

Consumer feedback is incredibly telling. “If they see a swap cabinet near their home, they’ll come buy my motorcycle. If a site malfunctions, they’ll complain vigorously,” Cai remarked. During the early stages, genuine consumer demand directly influenced the company’s development direction and strategy.

Cai and his team would set up swap cabinets according to user numbers, with every 70-80% increase in motorcycle sales requiring a 100% increase in swap cabinets. A shortage of swap cabinets could negatively impact consumer experience and electric motorcycle sales.

In terms of operations, 80% of the swap cabinets are set up and managed by SWAP, with the remaining portion operated by third-party franchises. Cai disclosed that the cost of each swap cabinet is under $2,000, with minimal maintenance costs. “Everything is designed to be automated; if an issue arises, the system will report it, allowing for remote troubleshooting.”

Unlike B-end monthly subscription packages in China, Indonesians have lower average consumption and are less likely to accept subscription payment plans. SWAP has digitized the refueling process, allowing electric motorcycle users to purchase additional mileage after riding distances of 100 kilometers or 500 kilometers.

A groundbreaking feature of SWAP’s swap cabinets is their support for offline battery swapping, as Indonesia’s communications network is not always reliable, which can lead to swapping failures during poor connectivity.

“In the C-end market, we cannot afford any major mistakes.” Cai recalls personally delivering batteries to address early malfunctions in swap cabinets, repeatedly apologizing.

After establishing 100 swap cabinet locations, SWAP secured a partnership with local internet giant Grab, whose operations include ride-hailing and

2-252x57.png)